Browse Case Studies

By Industry

- Aviation

- Automobile

- Banking / Finance / Insurance

- Consumer Goods

- Education

- Electronics and Appliances Retail

- Media and Entertainment

- Food / Beverage

- Manufacturing

- Pharmaceuticals / Biotechnology / Health Care

- Retail

- Software

- Steel Industry

- Information Technology

- Transportation

- Telecommunications

- » All Industries

By Regions

Case Study Books

-

Macroeconomics - Vol.I

Captures some of the global economic trends and the possible impact on the business fortunes. -

Managing Economies Vol.1

As the title suggests, the book captures recent economic crisis across the globe. How the respective... - Case Study Books »

Executive Briefs

-

New Recruit MBAs Attitudes

Executive Brief with Lopamudra Ray, Keya Gupta, Deepika Lingala. -

From Executive to Entrepreneur

Executive Brief with UDAYAN BOSE, Founder CEO, NetElixir - Executive Brief»

Course Case Mapping For Managerial Economics

This course is so fundamental to managers that many business schools across the world start their MBA programs with Managerial Economics. This course is also widely popular as Micro Economics, Economics for Managers, Business Economics. Managerial Economics provides the managers and the potential managers with the much sought-after economic rationale in - consumer behavior, pricing decisions, cost and revenue relationships, market structures (Perfect Competition, Monopoly, Oligopoly, etc). Being one of the introductory MBA courses, this course's efficacy is extended to various other courses and specializations. IBSCDC's Managerial Economics Course Case Map provides a comprehensive and managerial approach to teaching the course exclusively with case studies

Chapter : Introduction to Economics

Chapter : Introduction to Economics

Detailed Syllabus: Link between scarcity and efficiency, Production Possibility Frontier (PPF), Three problems of economic organization (what, how and for whom?), Free market mechanism, Invisible hand, Command economy, Mixed economy, Economic role of government, Externality, Public goods, Stabilisation and GrowthKey Concepts: Scarcity and Efficiency

Case Study: Water management in India: Does Scarcity lead to Efficiency?

Abstracts: The case studies the issue of water scarcity with reference to India. While the scarcity of a good generally leads to price hike and reduction in its consumption, in case of water – which is the very base of food and livelihood – there is hardly any room for cutting down the consumption. The only way out is to resort to water management. Whether water management should be guided by government regulation or market signals is explored through the course of this case.

- Background Reading/ Additional Reading:

- Chapter 1, “The Fundamentals of Economics”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “Economics: An Introduction and Vocabulary”, HBS Note

- “A Country is Not A Country”, HBR, Sept-Oct 1997

- “Clusters and the New Economics of Competition”, HBR, Nov-Dec, 1998

- Dolan G. Edwin, “Introduction to Microeconomics”, Third Edition

- “What Economics is About: Understanding the Basics of Our Economic System”, http://www.councilforeconed.org/resources/lessons/whateconisabout-sample.pdf

Key Concepts: Economic significance of scarcity, Link between scarcity and resource allocation, Production Possibility Frontier

Case Study: Trouble in Paradise: Water Scarcity in Cyprus

Abstracts: The case is primarily meant to investigate the link between scarcity of resources and efficiency in resource allocation. While human wants are unlimited, the means to satisfy these are limited. Faced with this predicament, people – both as individuals and as society – embark upon a strategy of prioritising their needs to address the most important ones first. The case takes a close look into the economic approach of Cyprus, which is afflicted with water scarcity. Whether scarcity pushes its economy to produce on its Production Possibility Frontier (PPF) and whether gardnermarket pricing or governmental restriction should be the modus operandi in the allocation of its scarce water resources is carefully investigated. Water-stressed Cyprus holds a fine template to discuss the various concepts like scarcity, desire, demand, PPF, opportunity cost, etc. and to debate on the relative merits and demerits of the mechanisms used to coax or coerce efficient resource allocation.

- Background Reading/ Additional Reading:

- Chapter 1, “The Fundamentals of Economics”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- Heskett James, “What Happens When the Economics of Scarcity Meets the Economics of Abundance?”, http://hbswk.hbs.edu/item/5469.html, August 4th 2006

- Gardner Gary and Clark Gregory, “The new scarcity?”, http://www.latimes.com/news/opinion/sunday/commentary/la-op-gardnermarketclark5may05,0,7868114.story?page=1,May 5th 2008

- ”The Basic Economic Problem”, http://www.west-dunbarton.gov.uk/EasySiteWeb/GatewayLink.aspx?alId=43879

- To have a understanding of introductory economic concept, ‘Introduction to Economics’, http://www.bized.co.uk/educators/16-19/economics/micro/presentation/econintro.ppt

- “Why Some Economies Grow And Others Don’t”, A Book Review on “Making Poor Nations Rich”

Key Concepts: Three problems of economic organisation (what, how and for whom?), Market economy, Command economy, Mixed economy

Case Study: Switzerland, Cuba and India: The Troika of Economic Problems in Three Economies

Abstracts: The reality of unlimited wants and limited resources to satisfy those wants stares all the economies of the world. Economies – whether capitalist, command or mixed – come face to face with triple basic economic issues of what to produce, how to produce and for whom to produce. Different economic systems like market economy, command economy and mixed economy have different ways of dealing with these problems. A market economy like Switzerland lets market forces come to play while a command economy like Cuba gets the controlling hand of government on all the aspects of the economy. In a mixed economy like India, both the government and the private enterprise pair up to set the economy to play. The case is an attempt to study the three types of economies and evaluate their performance in the touchstone of the above-cited central economic problems. Whether the Private enterprise by itself or Government alone or both toghther have the greatest potentiality to pull off success would come trickling out as one goes through the gripping details of the case.

- Background Reading/ Additional Reading:

- Chapter 1, “The Fundamentals of Economics”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “How Do Economies Grow”, HBR, May-June 1997

- To understand various types of economies, “Different World Economies”, http://www.curriculumlink.org/econ/Downloads/10000.ppt

- “The Competitive Advantage of Nations”, HBR, March-Apr 1990

- “What Drives Wealth of Nations”, HBR, July-Aug 1998

- “Why Protectionism Doesn’t Pay”, HBR,May-June 1987

- “The Gold Medal Partnership”, s+b

- “How Nations Thrive in the Information Age”, IBM Report

- “Economic Liberalization and Industry Dynamics”, HBS Note

Key Concepts: Externalities, Public goods, Causes of market failure, Role of government in the provision of public goods

Case Study: Externalities: Justification for Public goods?

Abstracts: The case gives an insight into the various market and non-market based ways of dealing with negative and positive externalities with reference to plastic and the river Ganges, respectively. However, there is hardly any private initiative towards abatement of the pollution in the Ganges. Whether this justifies the provision of public goods and the role of government in economic affairs is discussed and debated in this case.

- Background Reading/ Additional Reading:

- Chapter 2, “Markets and Government in a Modern Economy”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- Gene Callahan, “The Free Market ”, http://mises.org/freemarket_detail.aspx?control=367, August 2001

- Block Walter, “Public Goods and Externalities: The Case of Roads”, http://mises.org/journals/jls/7_1/7_1_1.pdf

- Vaknin Sam, “

- Is Education a Public Good?”, http://samvak.tripod.com/publicgoods.html

- Bohm P, “Estimating Demand for Public Goods: An Experiment,” European Economic Review, 1972, 3, 111-130

- Marwell, Gerald, and Ruth E. Ames, “Experiments on the Provision of Public Goods I:Resources, Interests, Group Size, and the Free Rider Problem,” American Journal of Sociology, 1979, 84, 1335-1360

- Rozeff S. Michael, “Why Market Failure Fails”, http://www.lewrockwell.com/rozeff/rozeff79.html

- MacKenzie D.W, “The Market Failure Myth”, http://mises.org/article.aspx?Id=1035, August 26th 2002

Key Concepts: Objectives of the economy, Role of government in stabilisation and growth of the economy

Case Study: Stabilisation and Growth of Canada: The Government’s job?

Abstracts: This case is meant to investigate the role of the government as regards the growth and stability of the Canadian economy. Canada designed elaborate social welfare state programmes, which pushed government spending. But the spiralling government deficits during the 1980s and early 1990s raised Canada’s total government debt-to-GDP ratio and diminished its international creditworthiness. Whether Canadian government rolled back its spending programmes, reformed its tax structure or resorted to the monetary and fiscal policies to achieve the twin objectives of an economy gets unveiled as one progresses with the case. The case offers an opportunity to assess the role of the government by providing a comparison of Canada with major advanced countries having relatively less governmental participation in the affairs of the economy.

- Background Reading/ Additional Reading:

- Chapter 2, “Markets and Government in a Modern Economy”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- "Capitalism With a Safetynet?", HBR, Sep-Oct 1996

- “A Country Is Not A Company”, HBR, Jan-Feb 1996

Chapter : Supply and Demand Analysis

Chapter : Supply and Demand Analysis

Detailed Syllabus: Demand schedule, Shape of Demand Curve, Shift in Demand Curve, Elasticity of Demand – Price, Income and Cross Elasticities; Link between price elasticity of demand and revenue, Supply Schedule, Shape of supply curve, Shift in supply curve, Price elasticity of supply, Equilibrium between demand and supply, Impact of tax on price and quantity, Distortions from government price control.Key Concepts: Demand schedule, Shape of demand curve, Shift in demand curve

Case Study: Do Soaring Price and Mounting Demand in Indian Gold Market Speak of a Paradox?

Abstracts: This case study carefully disentangles the causes and effects of the mounting demand for gold in India and helps analyze the shape and shift of demand curve for gold. In India, an increase in income is always accompanied by an increase in demand for gold, irrespective of its price. The entire world in 2008 witnessed uncertain economic conditions resulting from the global recession, which made investors switch their funds from distressed financial assets to the ever-alluring gold. This increased the investment demand for gold and kept the gold prices high, thus presenting the ultimate paradox of soaring price and mounting investment demand for gold. This paradox was not witnessed in the case of gold jewellery demand, as its demand started falling due to high gold prices and falling income levels of many due to worldwide recessionary impact

- Background Reading/ Additional Reading:

- Chapter 3, “Basic Elements of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- "Four Steps to Forecast Total Market Demand", HBR, July-Aug 1988

- From The People Who Bought You Vodoo Economics, HBR, May-June 1988

- To understand Demand Ananlysis:”Economic Principles Demand” http://www.slideshare.net/mrspurlin/3-demand-presentation

Key Concepts: Elasticity of demand Price, Cross and Income elasticity of demand, Link between price elasticity of demand, Revenue and business decision

Case Study: Mobile Telephony in India: Would Cheaper Rates Bring More Profits?

Abstracts: From call rates as high as INR 16/minute in 1995 to as low as INR 1/minute in 2008 and from a subscriber base of 0.03 million in 1995 to 346.9 million in 2008, India has come a long way in its tryst with what can be called a revolution in ‘mobile telephony’. Drastic reduction of call rates and handset prices lifted the mobile telephone sector from the red as Indians responded well to the cuts. As demand for mobile services saw a huge rise, the volume expansion more than counter-balanced the price reduction. The case study analyses the elasticity of mobile demand in India with respect to the change in not only its own price but also the price of a related good and the income of the consumers. The case also clues in the perceptive readers about an interesting link between the price elasticity of demand and the impact of change in price on revenue. Understanding this serves as a linchpin to the viability of business decisions. Fittingly, the case helps facilitate such understanding through the real life example of India’s experience with mobile telephony.

- Background Reading/ Additional Reading:

- Chapter 4, “Applications of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: Impact of tax on prices and quantity, Types of price elasticity, Link between price elasticity and sales revenue

Case Study: Ban on Public Smoking vs Imposition of Tax on Tobacco

Abstracts: The case is primarily meant to examine the impact of taxation on a product with reference to tobacco. In the course of the discussion, the case discusses the shapes and shifts of the demand and supply curves and explores the relationship between elasticity and revenue. The relative efficacy between the ban on public smoking and tax on tobacco is debated and many socio-economic, cultural and demographic factors are taken into consideration to get an insight into the consumer’s behaviour.

- Background Reading/ Additional Reading:

- Chapter 4, “Applications of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: Elasticity of demand

Case Study: Credit Cards – Boon or Bane An insight into Customer’s Choice: Are We in Savings Management or Expenditure

Abstracts: The case looks into the demand and supply scenario of credit card industry in India and examines the concepts of demand and supply saving management vs. expenditure management, consumer behaviour and elasticity. The case discusses about the players in the Indian credit market, various determinants of credit business and debates whether spending through credit cards is easy in a cash economy like India.

- Background Reading/ Additional Reading:

- Chapter 4, “Applications of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: supply and the shape of the supply curve, Difference between change in quantity supplied and change in supply

Case Study: Would Housing Be a Dream in the Dream City of India?

Abstracts: Mumbai is one of the most expensive cities in India to either rent or buy a place. There is a huge demand and supply mismatch in the housing sector, with demand outstripping supply of houses. This resulted in sky rocketing house prices. As prices of houses zoomed, the developers – in their bid to reap the benefits of high margins – endeavoured to augment the supply of houses. The high density of population in Mumbai has almost exhausted the avenues of enlarging the supply of houses. Constructing houses in the outskirts of Mumbai became the recourse. However, buying a house in Mumbai is beyond the reach of the low-income groups or even middle-income groups, as most of the supply is meant for high-income groups where the developers earn maximum profits. The global recession of 2008 has, however, brought about a fall in housing prices, which has made the developers of Mumbai cry a halt to the new housing projects. This case presents housing supply scenario in Mumbai and quizzes why increased supply of houses in response to high prices has not subdued the latter. In the process it helps in analysing the shape of supply curve and the difference between change in quantity supplied and change in the whole supply.

- Background Reading/ Additional Reading:

- Chapter 3, “Basic Elements of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “The Microeconomics of Industry Supply”, McKinsey Quarterly

Key Concepts: Market Equilibrium

Case Study: Executive Pay Package: A Study of Demand and Supply

Abstracts: The case study is meant to investigate whether equilibrium price of a good or service is born of the interplay between market demand and supply or other factors have a bearing on it. Revolving around the pay compensation of the US CEOs, the case is all set to prove that market forces determine the equilibrium pay package of the executives, the price for their highly skilled service. However, dissenting voices see a conspiracy in the much hyped scarcity of this rarefied talent. The case leaves open the factual position for the reader to see and take his stand.

- Background Reading/ Additional Reading:

- Chapter 3, “Basic Elements of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: Impact of taxation on price and quantity, Incidence of taxation

Case Study: Gas Taxes: US’s Dilemma

Abstracts: The case, set in the year 2005 for the US oil scenario, is meant to analyse and assess the impact of a tax on price and quantity and the final incidence of the tax between the consumer and the producer. In 2004, as the political instability in Iraq and the Middle East conflicts resulted in the skyrocketing of oil prices in the international oil market, the US found billions of dollars sucked out of its economy due to its overdependence on foreign oil market. The US was importing 11 million barrels of fuel every day, which constitutes 55% of its total consumption. For a long time, the economists had been advocating higher gas taxes as higher gas taxes would encourage Americans to explore reduction in fuel consumption and shift to fuel efficient cars. But politicians feared that any move to increase taxes would spell political suicide. What exactly was, and would be the outcome is discussed and debated through the course of the case.

- Background Reading/ Additional Reading:

- Chapter 4, “Applications of Supply and Demand”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Chapter : Consumer Behaviour

Chapter : Consumer Behaviour

Detailed Syllabus: Utility and choice, Marginal utility, Law of diminishing marginal utility, Law of equi marginal utility, Indifference Curve Analysis, Budget line, Substitution effect, Income effect, Paradox of value, Consumers equilibrium, Consumer surplus, Derivation of demand curve, Demand forecastingKey Concepts: Utility and Choice, Marginal utility, Law of diminishing marginal utility

Case Study: A Small Peek into Big B's Car Collections: Does the Law of Diminishing Marginal Utility Hold Good?

Abstracts: The case probes a fundamental law in economics by analysing Amitabh Bachchan’s car collection. Indian cine superstar, fondly called Big B, has one of the best collections of cars in India comprising at least 11 cars. A Rolls Royce Phantom, a Bentley Continental GT, a Mercedes SL500, a Porsche Cayman S, a Range Rover, a Lexus LX470, a Mercedes E 240, a BMW X5, a BMW 7 Series, a Mercedes S320 and a Ford Mondeo bedeck his parking porch. ‘Though wants are unlimited, a particular want is satiable’, is the banner line of the law of diminishing marginal utility. Whether this law has failed, with Big B shedding no passion in adding to his stock of cars or there is a failure in proper interpretation of the law is an exciting teaser for the reader. While the universality of the law is being debated, the case makes a swift side swing to discuss and deliberate on business implications of the law.

- Background Reading/ Additional Reading:

- Chapter 5, “Demand and Consumer Behavior”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- To understand how financial crisis is affecting US consumer behaviour from an managerial perspective, John A. Quelch and Katherine E. Jocz , “Keeping a keen eye on consumer behaviour”, http://www.ft.com/cms/s/0/54c4b492-f255-11dd-9678-0000779fd2ac.html, February 5th 2009

Key Concepts: Consumer surplus

Case Study: Tata’s Nano: A Small car with Large Consumer Surplus?

Abstracts: The case is a compelling study of the concept of consumer surplus with reference to the launching of Nano, the cheapest car in the world. With INR 1 lakh or thereabouts, Tata’s Nano is all set to conquest the low-end segment of the car clientele. Nano is the cheapest car, only in terms of cost and price – but not in terms of quality and consumer satisfaction. This promises loads of consumer surplus that will goad the hitherto car-deprived denizens to drive one. Whether this low-end smart car will prove a tribute to Tata’s enlightened business acumen or remain a pointer to adverse environmental consequences – only the future will tell. But that entails an intelligent evaluation of the cost and benefit to the society with the help of consumer surplus, the concept that this case so lucidly articulates.

- Background Reading/ Additional Reading:

- Chapter 5, “Demand and Consumer Behavior”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: Ordinal utility, Indifference Curve , Budget constraint and consumer's equilibrium

Case Study: Nitu's Business School Selection: Riding on an Indifference Curve

Abstracts: The case is meant to study the economic behaviour of a rational consumer who tries to maximise satisfaction within the constraint of the budget. Nitu Gupta (Nitu), an MBA aspirant, was initially caught in indecisiveness as to which B-School to join. B-Schools in India are categorised by Career Launcher, a leading education service provider in Asia, into eight clusters on the basis of assessment of seven parameters. Going by Career Launcher’s rankings, the best B-Schools that Nitu’s scorings could get her are the ones in cluster 4. But within cluster 4, whether she has to join Symbiosis Institute of International Business, Pune or Indian Institute of Technology – Department of Management Studies, Chennai or opt for IBS, Hyderabad is the moot point. The case eventually resolves the issue through its protagonist Nitu – but not before the notions of indifference curves and budget constraints come to hog the mindscape. How exactly these concepts help achieve the consumer’s equilibrium unravels as the reader thinks through the case.

- Background Reading/ Additional Reading:

- Chapter 5, “Demand and Consumer Behavior”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Chapter : Production and Cost analysis

Chapter : Production and Cost analysis

Detailed Syllabus: Production function, Link between Total, Average and Marginal Product, Short run and Long run, Returns to factor, Returns to scale, Product expansion, Technological change (Process innovation and Product innovation, Short run and Long run curves, Fixed Variable costs and Total cost, Link between Marginal cost and Average cost, Link between production and cost, Brea Even point and Shutdown pointKey Concepts: Role of science and technology in the economic development of Cuba

Case Study: Biotechnology in Cuba

Abstracts: After the Cuban revolution in 1959, Cuba chose science and technology to foster economic development. In line with Fidel Castro’s vision to provide free health care to his people, apart from developing an intellectual capital that could be finally converted into future tangible monetary benefits through trade and aid, Cuba pursued biotechnology to etch out a path for itself towards scientific excellence. Though haunted by the US’ trade embargo, Cuba was committed to usher in an economic resurrection.’

- Background Reading/ Additional Reading:

- Chapter 6, “Production and Business Organization”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- Koutsoyannis’s, “Modern Microeconomics”

Key Concepts: Break-even point and Shut down point

Case Study: Business viability of Dish TV: Would It Break or Breakeven?

Abstracts: Dish TV is the pioneer of DTH services in India. The concepts of break-even and shutdown are analysed with reference to Dish TV. The business viability depends on the cost rationalisation with a view to achieving profit maximisation. Whether incurrence of loss by a firm should necessitate its closure or it is worth the firm’s while to stay in business is probed with this case study. When a firm achieves break-even and when it does not, and what needs to be compared to decide the firm’s shutdown are some of the interesting aspects discussed in the run of the case. The case throws light on an important issue of business operation: a firm cannot escape the costs, which have already been sunk. Whether Dish TV would be a success story after achieving break-even or the probability of it being forced to shutdown still exists, depends not only on the realised figures of its annual report but also on its future expectations concerning revenue and cost.

- Background Reading/ Additional Reading:

- Chapter 8, “Supply and Allocation in Competitive Markets”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “Applying Dimensioinal Analysis to Understand Cost Drivers”, HBS Note

- “Relevant Costs and Revenues”, HBS Note

- “Vital Truths About Managing Your Costs”, HBR, Jan-Feb 1990

Chapter : Market Structure analysis and estimation

Chapter : Market Structure analysis and estimation

Detailed Syllabus: Price and Output determination under perfect competition, MonopolyKey Concepts: Perfect Competition

Case Study: Perfect Competition under eBay: A Fact or Factoid?

Abstracts: The case has been especially developed with the intent to exhaustively analyse the various features of a perfectly competitive market with reference to eBay. eBay, founded by Pierre Omidyar, a software developer, in September 1995, is the online auction giant which flaunted its first mover advantage spectacularly. It is an American website headquartered in San Jose, California and acts as the world’s online marketplace facilitating large scale trade of varied items globally. Perfect competition is an ideal market structure rarely found in the real world, which is a receptacle of imperfect competition. However, many important features of perfect competition like large number of buyers and sellers, information symmetry, low barriers to entry and to some extent homogenous products are manifest in eBay. But whether eBay may truly be considered a perfectly competitive market awaits understanding of a few basic issues that would arise as the case comes under interesting discussion that it merits.

- Background Reading/ Additional Reading:

- Chapter 8, “Supply and Allocation in Competitive Markets”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “Online Auction Markets”, HBS Note

- “Online Market Makers”, HBS Note

Key Concepts: Monopoly

Case Study: Mexican Telecom Industry: (Un)wanted Monopoly?

Abstracts: This case helps to analyse how Telmex and Telcel are aided by various factors to maintain their dominance. It can also be used to determine the market concentration and monopoly power of a company. What are the social costs of a monopoly? How weaknesses in the legal and political systems help in upholding unhealthy business environment? How lack of competition is detrimental for an economy? All these posers are probed in the run of this case.

- Background Reading/ Additional Reading:

- Chapter 9, “Imperfect Competition and the Monopoly Problem”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “Price Discrimination”, HBS Note

- “Monopoly Power, Innovation and Economic Growth”, The Australian Economic Review

- “Mexico: Opening Ahead of Eastern Europe”, HBR, Sep-Oct 1990

Key Concepts: Cartel

Case Study: OPEC: The Economics of a Cartel (A)

Abstracts: The basic premise of this three-part case is to let the students derive as many economics concepts as possible from OPEC and the economics of cartel. This would enable them to derive major micro economics concepts – market structure, cost structure, consumer behaviour and related concepts – and can also be linked to Game Theory (as is done in the Case Study (C)). These three cases can be used in managerial/business economics courses and the economics of competition in a strategy module. The first case deals with the intricacies of OPEC; the necessity, the origination and the evolution of the organisation into a cartel. It was argued that since the oil exporters were exploited by the western governments and the multinational corporations, OPEC was created. And the organisation pledged to safeguard members’ interests. After having understood the historical foundations of OPEC, the students can analyse OPEC’s nature and the interlink ages between oil industry’s supply and demand dynamics.

- Background Reading/ Additional Reading:

- Chapter 10, “Oligopoly and Monopolistic Competition”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- “Cartels and Competition: Neither Markets Nor Hierarchies”, HBS Working Paper

Key Concepts: Effects of cartelisation on supply and demand in the global oil supplies

Case Study: OPEC: The Economics of a Cartel (B)

Abstracts: The second case, in the three part case study series, deals with competitive dynamics of OPEC. In economics some words are considered notorious for their implications – one such word is cartel. Everyone who saw ‘God Father’, would draw parallels to cartel’s clandestine motives and actions. After having established the objectives of forming OPEC, this case enables the students to debate on the ways and means adopted to reach its objectives. Even if the OPEC countries produce oil at lower levels than their capacity, they would still have surplus, but the global oil supplies will be strangled. The OPEC members used this strategy to control global oil prices as early as in 1970s. However, by mid-1980s OPEC was unable to withstand the competitive pressures from the non-OPEC countries. Under these circumstances OPEC started to behave more like a cartel and faced many challenges. This case could be used to analyse pricing mechanism of oil and, the effects of cartelisation on supply and demand in the global oil supplies.

- Background Reading/ Additional Reading:

- Chapter 10, “Oligopoly and Monopolistic Competition”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

Key Concepts: Price Leadership

Case Study: OPEC: The Economics of a Cartel (C)

Abstracts: The third and final case, Case (C), deals with the output and pricing mechanism of oil among OPEC members. OPEC members decided upon output quotas and price levels of oil. In order to achieve higher profits, by crippling supplies in the international markets, they did not expand their outputs – which led to fluctuations in the prices. No increase in supplies made the dealers stock oil and further increase the price and OPEC, through this process, has made enormous profits. They also began to discriminate between their customers by following differential price mechanism – making OPEC the price leader.

- Background Reading/ Additional Reading:

- Chapter 10, “Oligopoly and Monopolistic Competition”, Economics, Paul A. Samuelson and William D. Nordhaus, (15th edition)

- To understand Game Theory – Dixit Avinash, Professor of Economics at Princeton University, “Game Theory explained”, http://www.pbs.org/wgbh/amex/nash/sfeature/sf_dixit.html

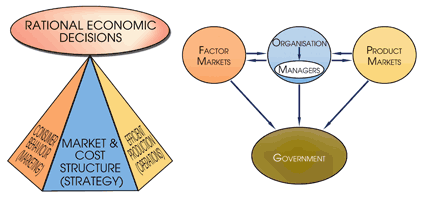

- Economic Behavior of Consumers/Customers

- Economic Behavior of Producers/Managers

- Market and Cost Structures and the Accompanying Dynamics

The 'Three Themes' of this Course are

- Why do economic problems crop up and how do people organise to address the basic economic problems?

- What dictates consumption patterns of consumers? Why do consumers behave the way they do?

- Why do companies produce? What determines the profit levels of companies operating in different market structures?

- What relationship/relevance has this course got with business decision making – especially in developing optimal strategies to compete with rivals and co-operate with partners in a competitive environment?

- Do you find it useful to apply basic economic reasoning to other related topics in business studies such as marketing, finance and organization?

This Course Seeks to Address the Following Questions

Why Managerial Economics for an MBA?

©IBSCDC

- “Wealth of Nations” (at least a few chapters)

- “Freakonomics”, Steven D. Levitt and Stephen J Dubner

- “The Undercover Economist”, Tim Harford

- “Hidden Order: The Economics of Everyday Life”, David D. Friedman

- “Armchair Economist: Economics & Everyday Life”, Steven E. Landsburg

- “Naked Economics: Undressing the Dismal Science”, Charles Wheelan

- “More Sex Is Safer Sex: The Unconventional Wisdom of Economics”, Steven E. Landsburg

Widely Used Books for Managerial Economics

- The Godfather

The Godfather is a great movie to discuss on the issue of cartels. The movie shows that people turn to mafia for help because of corrupt and self serving nature of the political institutions.

- Blood Diamond

Blood Diamond, The film set during the Sierra Leone Civil War in 1997–1998 reveals that blood diamonds also known as conflict diamonds, were so named to call attention to the fact that diamonds were being smuggled out of countries at war specifically to buy more arms. Blood Diamond shows the mismanagement by the government. Even though Sierra Leone has abundance of resources, it has abysmal economic growth due to abject governance and graft.

- Erin Brockovich

Erin Brockovich shows Julia Roberts as a brave activist, who believes that many of the health problems caused amongst the residents of a small town in US is because of a corporation whose waste chemicals ended up in their water. This is a great film for a discussion on externalities(contaminated water causing illness among the residents in the neighourhood).

- The Insider

The Insider ,starring Al Pacino as a tough reporter and Russell Crowe as the hard-working scientist trying to get out the truth about Big Tobacco, is a good movie to talk about corporate responsibility, free choice, and elasticity of demand for addictive products.

- Goodbye Lenin

Goodbye Lenin, a movie set in East Germany, examines the economic and social impact of transition from a state economy to a market economy. The movie shows how improvements in consumer goods happen with the destruction of state services and decontrol of market economy. The movie shows that both Eastern and Western political systems have their flaws and ultimately it is important to be near the loved ones.

- A Beautiful Mind

A Beautiful Mind depicts the life of the Nobel Prizewinning mathematician and schizophrenic John Nash. Hailed as a mathematical genius and one of the most original minds of the 20th century, Nash made his breakthrough as a twenty-year-old graduate student at Princeton with a stunning proof in the field of game theory. During the period of his recovery, game theory became a foundation of modern economic theory.

Economics in Hollywood

Must-read Article Inventory

- “Economics: An Introduction and Vocabulary”, HBS Note

- “Micro Economics for Strategists”, HBS Note

- “A Country is Not a Company”, Paul Krugman, HBR, January–February, 1996

- “Strategy and the New Economics of Information”, HBR, September–October 1997

- “How Do Value Creation and Competition and Determine Whether a Firm Appropriates Value”, Management Science, October 2004

- “A Student’s Guide to Economics”

- “Clusters and the New Economics of Competition”, HBR, November–December 1998

- “The Surprising Economics of a “People Business””, HBR, June 2005

Introduction

- “How Do Economies Grow”, HBR, May–June 1997

- “The Competitive Advantage of Nations”, HBR, March–April, 1990

- “What Drives Wealth of Nations”, HBR, July–August 1998

- “The Gold Medal Partnership”, s+b

- “How Nations Thrive in the Information Age”, IBM Report

Government and Business

- “Four Steps to Forecast Total Market Demand”, HBR, July–August 1988

- “From the People Who Brought You Vodoo Economics”, HBR, May–June 1988

- “The Microeconomics of Industry Supply”, McKinsey Quarterly

The ‘Economic’ Consumer and Producer

- “What Really Drives The Market”, SMR, Fall 2005

- “Why Protectionism Doesn’t Pay” , HBR, May–June 1987

- “On-line Auction Markets”, HBS Note

- “On-line Market Makers”, HBS Note

- “Price Discrimination”, HBS Notes

- “Relevant Costs and Revenues”, HBS Note

- “Applying Dimensional Analysis to Understand Cost Drivers”, HBS Note

- “Competition for Monopoly II – Entry and Exit”, Bulletin of Economic Research, 1991

- “Cartels and Competition”, HBS Working Paper

- “Strategies for Staying Cost-Competitive”, January–February 1984

Market and Cost Structures

Buy This Case Pack

- Course Pack contains

- 22 Case studies

- 18 Structured Assignments

- 20 Teaching Notes

Related Links

Executive Interviews

- Don Sull

Speaks on Strategy Execution -

Bala Chakravarthy

Speaks on Global Economy and Global Managers -

David Ahlstrom

Speaks on Global Economy and Global Managers -

Jittu Singh

Speaks on Global Economy and Global Managers - James Higgins

Speaks on Strategy Execution - Executive Interviews »

Video Interviews

-

Kiran Bedi

Speaks on Police Reforms & Women As Leaders -

Arun Shourie

Speaks on Disinvestment & Education in India -

Maya Aoki

Speaks on Myherbalife.com's Franchisee Business Model and Her Entrepreneurial Journey - more Video Interviews»